maine excise tax calculator

To calculate your estimated registration renewal cost you will need the following information. Maine residents that own a vehicle must pay an excise tax for every year of ownership.

Cigarette Excise Taxes In Select States Per Pack Infographic Http On Wsj Com K81nby Infographic The Selection National Association

WHAT IS EXCISE TAX.

. Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The state excise tax on gas in Maine is 30 cents per gallon of regular gasoline. Please note this is only for estimation purposes the exact cost. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject.

Texas instruments ti-36x pro scientific calculator. Re-register your vehicle online by clicking HERE. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle.

Navigate to MSN Autos. The excise tax is payable to the Town of Eliot Maine and can be paid at. Excise Tax Estimator Please note.

Contact 207283-3303 with any questions regarding the excise tax calculator. If you know the sticker price of a new car you can calculate the excise tax by. For example if the.

Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below. 2600000 550002545000 2545000 x 02461080 The excise tax due will be 61080 A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a. For example a 3 year old car with an MSRP of 19500 would.

The Maine state sales tax rate is 55 and the average ME sales tax after local surtaxes is 55. Purchase Amount Purchase Location ZIP Code -or-. Select the year of your.

Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. Maine Gas Tax. Under Used Cars select the make and model of your vehicle and click Go.

04210 04211 and 04212. Your vehicles MSRP The MSRP is the Manufacturers Suggested Retail Price of your vehicle. Additional levies on fuel are collected for the Ground and Surface Waters.

- NO COMMA For. The rates drop back on January 1st each year. Like all states Maine sets its own excise tax.

It provides an estimate to give you an idea of what your registration renewal amount will be. For example if you purchase a new vehicle in Maine for 40000. Sixth and subsequent years 400 per 1000 of MSRP.

Scroll down for estimated cost using our excise tax calculator Re-registrations- Proof of insurance Mileage. Anytime during our business hours. The Auburn Maine sales tax is 550 the same as the Maine state sales tax.

Online calculators are available but those wanting to. Excise Tax is an annual tax that must be paid prior to registering a vehicle. Excise Tax is an annual tax that must be paid prior to registering your vehicleExcept for a few statutory exemptions all vehicles including boats registered in the State of Maine are subject.

The excise tax you pay goes to the construction and. This calculator does not provide a quote. - NO COMMA For.

Enter your vehicle cost. Fifth year 650 per 1000 of MSRP. Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle.

You now have the option to. How to Calculate your Vehicle Excise Tax For new vehicles purchased from a dealer take you final window sticker price subtract destination charges and multiply times 024. Enter your vehicle cost.

Youll be taken to a page for all years of the particular vehicle. Like all states Maine sets. In short if the vehicle is registered in the state of Maine then the Maine car sales tax of 550 will be applied.

Excise Tax Calculator Home DEPARTMENTS FINANCE VEHICLE REGISTRATION EXCISE TAX CALCULATOR The calculator below will help give you an idea of what it will cost to renew the.

Maine Income Tax Calculator Smartasset

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

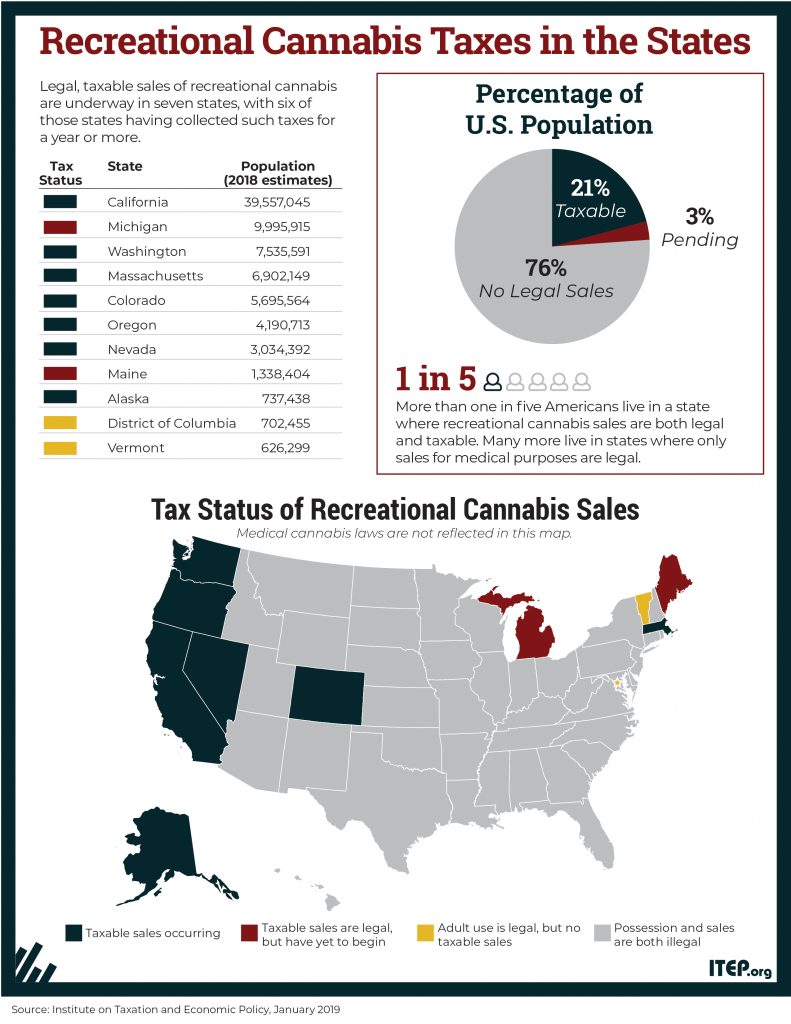

Maine Reaches Tax Fairness Milestone Itep

Historical Maine Tax Policy Information Ballotpedia

Augusta Councilors Approve Tax Break For 250 Unit Housing Development Centralmaine Com

Vehicle And Trailer Registration Town Of Easton Maine

Motor Vehicle Registration The City Of Brewer Maine

Tobacco Cigarette Tax By State 2022 Current Rates In Your Jurisdiction

Maine Who Pays 6th Edition Itep

State Income Tax Rates Highest Lowest 2021 Changes

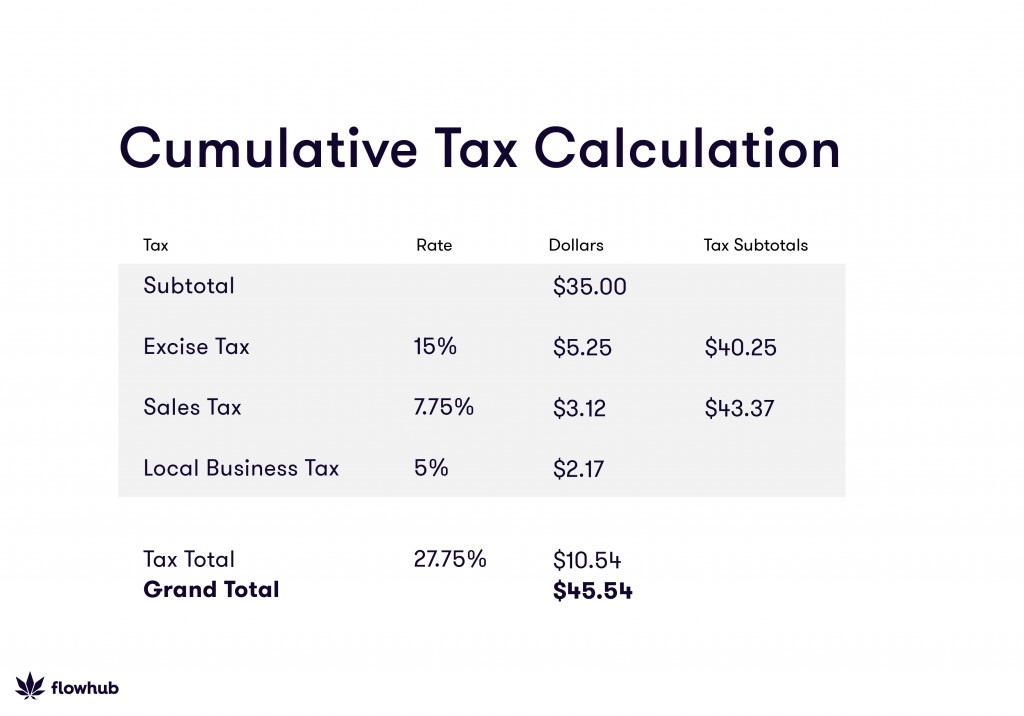

How To Calculate Cannabis Taxes At Your Dispensary

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Maine Car Registration A Helpful Illustrative Guide

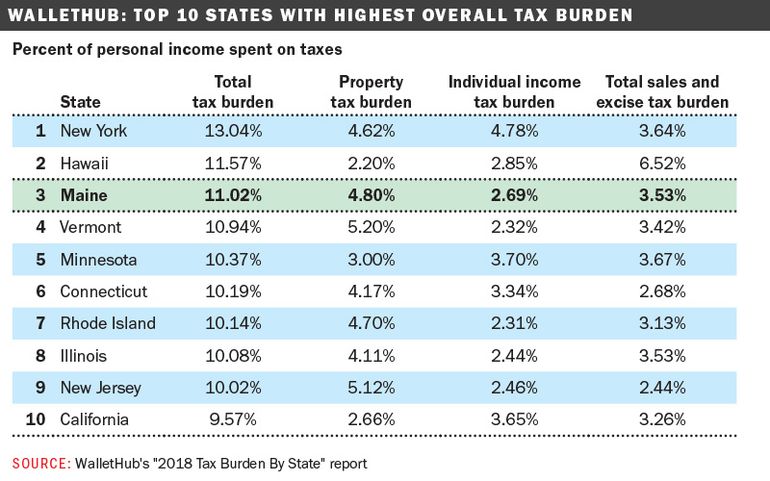

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

Motor Vehicle Excise Tax Finance Department

Which States Have The Highest Taxes On Marijuana Priceonomics